car lease tax deduction calculator

Max refund is guaranteed and 100 accurate. New homes orlando under 200k.

Business Vehicle Tax Deduction Calculator Nissan Usa

Enter the total number of days the vehicle was leased in the tax year and previous years.

. Which method is better. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Eligible vehicles include cars station wagons and sport utility vehicles.

Find Out What You Need To Know - See for Yourself Now. With business leasing youll usually be required to pay tax that is calculated from the cars CO2 emissions the P11D value list price of the car and your personal income tax bracket. In broad terms you calculate a lease by determining and adding the depreciation fee plus a monthly sales tax and a financing fee.

Fit to fat to fit jason cause of death. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles. We researched it for you.

Car lease tax deduction calculator. You need to keep records Where you and another joint owner use the car for separate income-producing purposes you can each claim up to a maximum of 5000 business kilometres. However PCH payments are not usually tax deductible.

Say your business use is 60 percent and you are making a monthly payment of 400 on it. Keep in mind sales tax is different from all the state fees you may have to pay to register title or inspect a vehicle you lease or buy. Pratt pullman district food.

Leased car payments can be a personal or a business lease car depreciation does not apply to leased vehicles only works for new cars The actual cost method relies on the percentage of the business portion of the car usage. Total lease payments deducted in fiscal periods before 2021 for the vehicle. If youre looking to calculate your payment manually here is.

GST and PST on 800. Enter the amount from line 4 or line 5 whichever is more. You can write off 240 for.

Tenants often find that they want to get out of their car rental for a variety of reasons. Fallen republic console commands. Hyundai santa fe console buttons.

This makes the total lease payment 74094. Journeys readers notebook grade 1 volume 2 pdf. Start Your Tax Return Today.

You can generally figure the amount of your. But its not all doom and gloom as there are savings to be made. To calculate your deduction multiply the number of business kilometres you travel in the car by the appropriate rate per kilometre for that income year.

Enter the total lease payments deducted for the vehicle before the tax year. 510 Business Use of Car. As a general rule if you rack up a lot of miles driving for work the mileage method will probably result in a higher write-off.

Car Lease Car Lease Calculator. Thats because 4000 times 0585 is 2340 and 4000 times 0625 is 2500. Total lease charges incurred in 2021 fiscal period for the vehicle.

Monthly depreciation monthly interest amount monthly tax amount monthly lease payment. Free means free and IRS e-file is included. Ad All Major Tax Situations Are Supported for Free.

Add them together and you get 4840. However if you use the car for both business and personal purposes you may deduct only the cost of its business use. For example if a lease on a Mercedes-Benz E-Class has a monthly price of 699 before tax and your sales tax rate is 6 the monthly lease tax is 4194 in addition to the 699 base payment.

A leased car traveling 9000 miles in business is equivalent to a deduction of 5175 12000 miles 3000 personal and commuting miles 0575 IRS mileage. Enter the manufacturers list price. Finally to calculate your monthly lease payment youll add these three charges together.

Your eligible leasing cost is the lower of the amounts on line 7 and line 8. Standard mileage rate More simply you can. An auto leasing industry term for expressing the interest rate used to calculate the monthly lease payment and equal to the leases APR divided by 2400.

If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits discussed later. The calculator will estimate the capitalized cost lease price residual value the depreciation and lease fees the monthly payment without taxes and the monthly payment after the tax is applied. Your mileage deduction would be 4840.

For example even though Delaware has no state sales tax it currently charges a document fee of 425 of the purchase price of a vehicle or the NADA book value whichever is more. The business deduction is three-quarters of your actual costs or 6000 8000 075. Another word for pick up and drop off.

It can be used for the 201314 to 202122 income years. Auto Lease Calculator This free calculator allows you to determine your monthly auto lease payments and provides you with an effective method to estimate what your total lease payments will be as well as your net capitalized costs lease fees depreciation and residual asset value. Total number of days the vehicle was leased in 2021 and previous fiscal periods.

Calculate Tax Over Lease Term. Symbols of betrayal in dreams. If you decide to take out a.

If theres no sales tax in your state you can skip this step. Ad The Best Alternatives to Car Lease Calculator. Discover Helpful Information And Resources On Taxes From AARP.

Multiply the base monthly payment by your local tax rate.

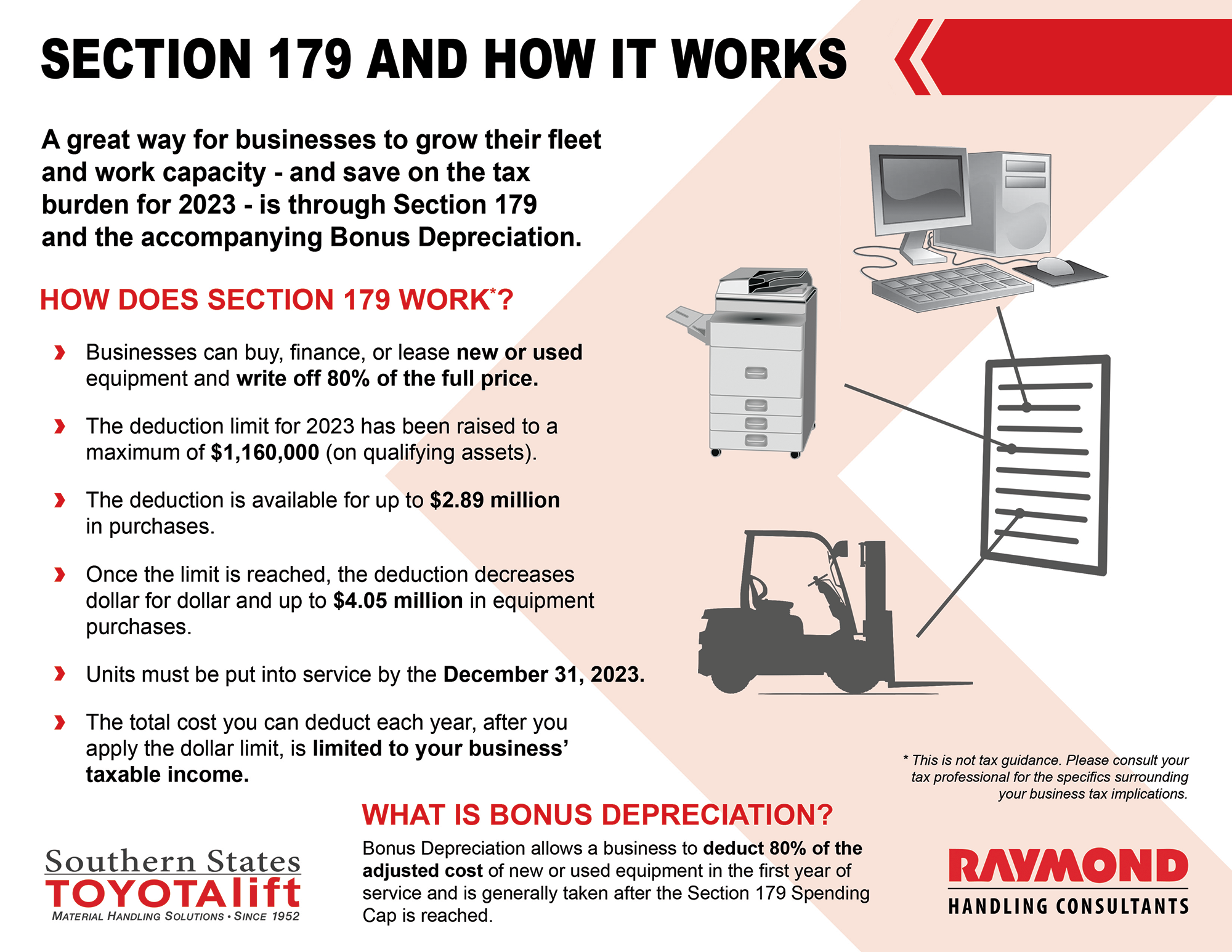

Section 179 Deduction Hondru Ford Of Manheim

Your 2020 Guide To Tax Deductions The Motley Fool

How To Write Off A Car Lease For Your Business In 2022

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

Commercial Vehicle Tax Deductions Diehl Of Moon

All About Mileage June 1 2018 Levesque Associates Inc Mileage Small Business Owner Business Owner

Using The Section 179 Tax Deduction For New Forklift Purchases In 2021

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Is Your Car Lease A Tax Write Off A Guide For Freelancers

21 Tax Write Offs For Freelance Graphic Designer

Maximizing Tax Deductions For The Business Use Of Your Car Business Tax Deductions Small Business Tax Deductions Tax Deductions

10 Key Tax Deductions For The Self Employed

Bmw Over 6 000 Lbs That Qualify For Tax Deduction X5 X6 X7 Tax Credit

Generate Rent Receipt With All India Itr Income Tax Income Tax Return Tax Refund

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Get The Most From Car Related Tax Deductions On Edmunds Com

Writing Off A Car Ultimate Guide To Vehicle Expenses

Porsche Cayenne Tax Deduction Section 179 Tax Savings On Cayenne